tax loss harvesting limit

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Tax loss harvesting example.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

This can significantly reduce an investors tax bill.

. To tax-loss harvest Mary would sell that fund thereby recognizing a 7000 capital loss. Contact a Fidelity Advisor. Assuming youre subject to a 35 marginal tax rate the overall tax benefit of.

The leftover 2000 loss could then be carried forward to offset income in future tax years. Tax efficiency is a key. There is a 3000 limit on the amount of capital gains losses that a federal taxpayer can deduct in a single tax year.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. If you invested 5000 in an energy stock last year but today its worth 4000. However even if you dont have capital gains to report you can tax loss harvest to lower your tax bill.

When used correctly tax-loss harvesting can help you realize significant tax savings. In the 24 tax bracket that would come out to 024 4000 960 paid in short term capital gains and 015 4000 600 in long term capital gains. Even if you cant claim the maximum 3000 net loss you can still reduce the value of your gains and save on taxes that way.

Limit capital gains for your clients Help your clients offset short-and long-term capital gains with automatic tax-loss harvesting of client accounts. Currently the amount of excess losses you can claim as a. As a result any opportunity to enhance the probability of success is paramount.

The result of tax-loss harvesting is that taxes are only paid on the net profitthe difference between the gains and the losses. 3000 per year for individual filers or married. However Internal Revenue Service IRS rules allow additional losses to be.

If your losses completely offset your gains then that leftover amount can be used to offset your taxable income. You can report up to 3000 per year in losses and offset income. 6 hours agoIn some cases you are simply deferring the payment of your tax particularly if you are using your capital losses from tax-loss harvesting against capital gains on the same.

However there are limits to the amount of taxes on ordinary income that can be. Online Assist add-on gets you on-demand tax help. And Mary would use the proceeds from the sale to purchase another fund to serve as a.

Is There a Limit to How Much Tax-Loss Harvesting Can Be Used Annually. In fact the risk of a loss of some type is almost always a threat. The upside of losing is limited to 1500 to 3000 a year.

As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting. Tax-loss harvesting can offer tax benefits but there are limitations on what you can deduct. Tax-loss harvesting limit.

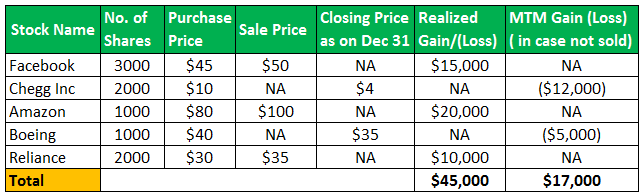

Tax loss harvesting referred as Tax loss selling is a strategy used by the taxpayer to offset the liability related to capital gain tax arises on sale of securities either short term or long term. Investors are allowed to claim only a limited amount of. So if you have a 4000 gain and a.

There is no limit to the amount of investment gains that can be offset with tax-loss harvesting. Fret not you can sell the investment buy another and claim the. In addition the IRS allows you to use up to 3000 of the remaining capital loss to lower your ordinary taxable income each year.

In this example the final 2000 is carried.

Crypto Tax Loss Harvesting Investor S Guide Koinly

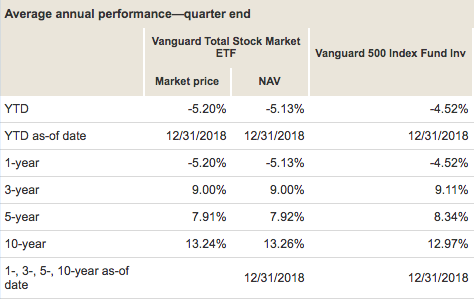

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Reap The Benefits Of Tax Loss Harvesting

Tax Loss Harvesting And Tax Gain Harvesting Step By Step

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting Definition Example How It Works

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Crypto Tax Loss Harvesting Investor S Guide Koinly

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Turning Losses Into Tax Advantages

Turning Losses Into Tax Advantages

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Crypto Tax Loss Harvesting Investor S Guide Koinly

Tax Loss Harvesting Definition Example How It Works

Tax Loss Harvesting Example Of Tax Loss Harvesting How Does It Work